If you're looking to start an LLC in KS, you'll want to adhere to specific procedures to keep things smooth and within legal bounds. From selecting a name that meets legal requirements to making sure you’ve got someone managing legal documents, each step is important. Establishing an operating agreement and keeping up with official timelines might appear overwhelming, but it’s all manageable. Want to avoid common mistakes? Understand exactly what to do next.

Choosing a Unique Name for Your Kansas LLC

Before you file any paperwork, you’ll need to pick a unique name for your KS LLC. Your company name must differently identify your enterprise from others on record with the Kansas Secretary of State.

Check the official business name database to make sure your desired name’s free for use. Your LLC’s designation should encompass “Limited Liability Company,” “LLC,” or “L.L.C.” Avoid using terms designated for financial or insurance entities unless you fulfill specific criteria.

Make sure your name isn’t misleading or confusable with current companies. Once you find a compliant, untainted name, you’re prepared to proceed to the next step in formation.

Appointing a Official Representative

Each Kansas LLC needs a registered agent to accept official paperwork and official notices on behalf of the enterprise. You must adhere to this requirement—appointing a registered agent is required by Kansas statutes.

Your designated individual must have a real address in Kansas, not just a P.O. box. You can appoint yourself, another member, or hire a professional service. Whoever you choose, they must be present during standard office hours to guarantee you do not miss important paperwork.

Choosing a reliable registered agent ensures your LLC stay in good standing and ensures you’re up-to-date get more info with essential legal issues.

Filing Your Articles of Organization

The following essential task is filing your Articles of Organization with the State of Kansas Administration. This document officially creates your LLC in Kansas.

Fill out the document online or obtain it from the Secretary of State’s online portal. You’ll need your LLC’s name, key agent details, mailing address, and the organizers' names.

Double-check all information to ensure correctness—mistakes can cause procedural delays or even cause rejection. Submit the state filing fee, then send the filled application electronically or by mail.

Once validated, you’ll obtain a certification, formally acknowledging your LLC. Keep this confirmation for your company files and future reference.

Creating an Operational Contract

Although KS has no mandate for an operating agreement for your LLC, preparing one is highly advisable to establish definite guidelines and member responsibilities.

With an operating agreement, you’ll outline each partner’s privileges, responsibilities, and share of profits or loss allocations. This charter can also clarify voting procedures, organizational hierarchy, and rules for adding or expelling partners.

By documenting all terms, you’ll reduce potential conflicts and protect your business’s status as a distinct legal form. Even if you’re a single-member LLC, having an operating agreement can demonstrate professionalism and prevent discrepancies or misunderstandings down the road.

Don't skip this step.

Complying With Kansas State Requirements

Once your LLC has fulfilled its domestic structure with an operational plan, it's time to turn attention to Kansas's official requirements.

File your Articles of Organization with the Kansas Secretary of State, via electronic submission or postal services. Designate an official representative with a valid physical location in Kansas who can receive legal documents on your behalf. Don’t forget to pay the appropriate filing fee.

After formation, Kansas requires all LLCs to file an annual report by the 15th day of the fourth month after your fiscal year ends. Missing this deadline could result in fines or administrative dissolution.

Conclusion

Forming an LLC in Kansas is straightforward when you follow the right steps. Start by picking a unique name, appointing a registered agent, and filing your Articles of Organization. Even though it’s not required, drafting an operating agreement helps prevent future misunderstandings. Don’t forget about annual reports to keep your business in good standing. By taking these steps, you’ll set your Kansas LLC up for compliance, protection, and sustained success. Now, you're prepared to begin!

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! Nadia Bjorlin Then & Now!

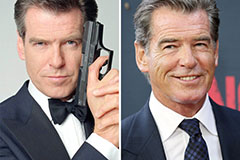

Nadia Bjorlin Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!